In 2010, two entrepreneurs, Adam Neumann and Miguel McKelvey, founded WeWork with a vision to revolutionize the workplace. Neumann, the charismatic and unconventional CEO, envisioned a community-driven workspace that would foster collaboration, innovation, and a sense of belonging among its members.

WeWork's spaces were designed to be more than just desks and chairs; they were vibrant hubs where people could connect, socialize, and unleash their creativity.

Lets understand how the wework operated

WeWork rents buildings from property owners at one price and then rents them out to clients at higher prices, generating most of its revenue from its flexible work-space locations in the US.

Imagine WeWork rents a building from a property owner for $100,000 per month.

This is the cost of the space.

WeWork then divides this space into smaller offices, desks, and meeting rooms, and rents them out to clients.

For example, they might rent out a small office for $2,000 per month, a desk for $200 per month, and a meeting room for $100 per hour. This is the revenue WeWork generates from its clients.

The difference between the cost of the space and the revenue from the clients is WeWork's profit. In this example, if WeWork rents out all of the space they have, they would make a profit of $30,000 per month.

As you can see, WeWork makes a lot of money by renting out its flexible workspaces to clients. This is why the company has been so successful, and why it has been able to grow so rapidly.

Here are some additional insights about WeWork's business model:

WeWork's business model is based on the idea that people are willing to pay more for a flexible workspace that is located in a prime location and has a lot of amenities.

WeWork also makes money by selling other services to its clients, such as printing, catering, and conference room rentals.

WeWork has a membership program that allows clients to access its workspaces in any city where WeWork has a location.

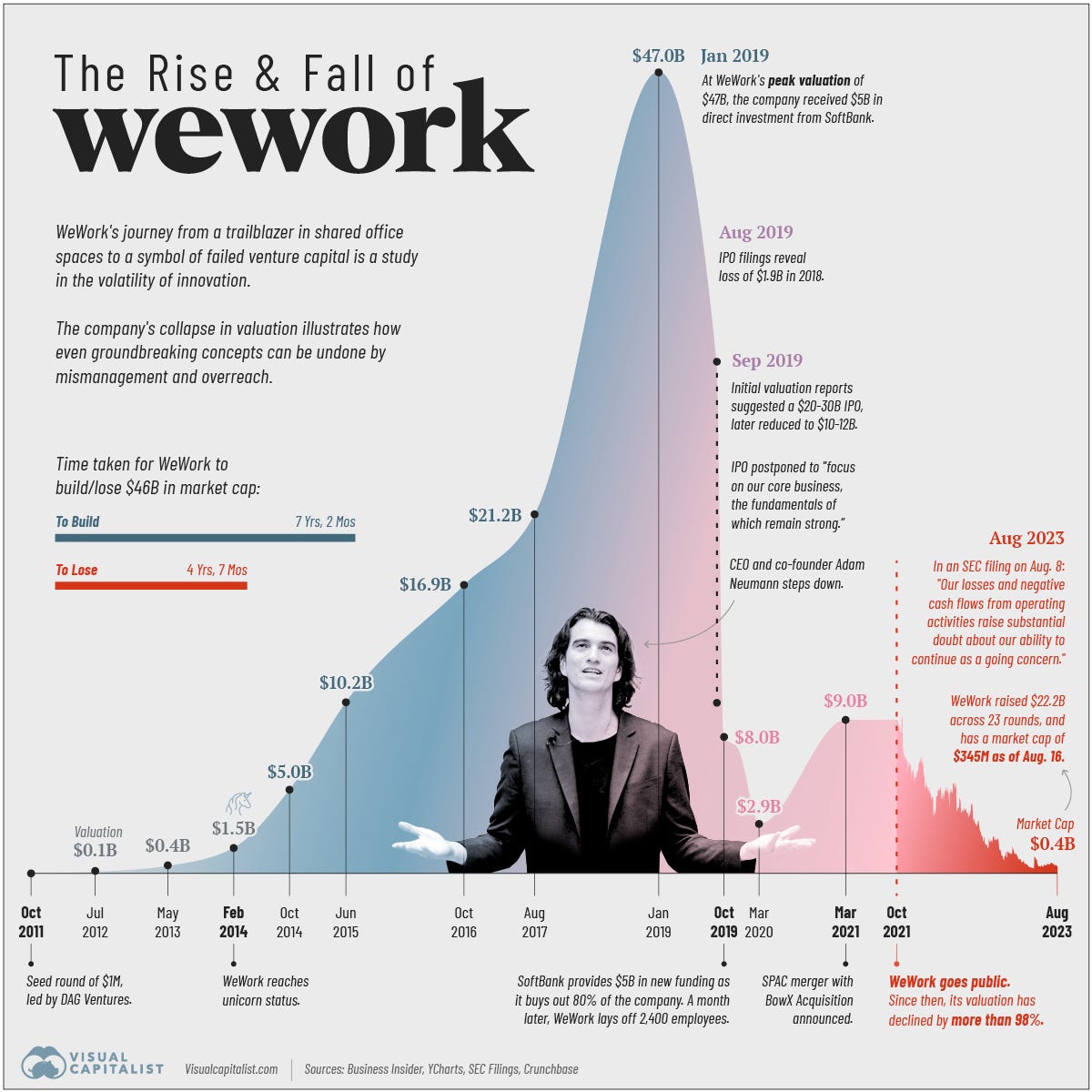

WeWork's growth was nothing short of astonishing. As the company expanded rapidly, attracting a growing number of members, it also attracted the attention of venture capitalists who poured billions of dollars into the company.

With this influx of cash, WeWork embarked on an aggressive expansion spree, opening new locations around the world at an unprecedented pace.

This expansion, however, was fueled by a business model that was inherently flawed.

WeWork's aggressive expansion strategy came with a hefty price tag.

The company had entered into long-term leases for massive office spaces, often at inflated rates. This resulted in staggering occupancy costs that far outweighed WeWork's revenue from membership fees. As the company's losses mounted, investors grew increasingly concerned about its ability to turn a profit.

To understand it in more details

In 2019, WeWork's annual report showed that the company had a staggering $47.2 billion in lease commitments. This meant that the company was obligated to pay an average of $13.05 billion per year in rent for the next five years.

In 2019, WeWork's occupancy costs were $10.4 billion, while its revenue from membership fees was only $9.6 billion. This meant that the company was losing money at an alarming rate.

Investors were also concerned about the fact that WeWork had entered into long-term leases for massive office spaces at inflated rates.

This meant that the company was locked into expensive contracts that would be difficult to break if it needed to downsize in the future.

The dam of WeWork's financial troubles finally burst in 2019 when the company announced its plans to go public.

However, as investors scrutinized WeWork's financial statements, they uncovered a litany of red flags, including questionable accounting practices, inflated valuations, and a culture of lavish spending. The revelations about WeWork's financial mismanagement and Neumann's controversial personal dealings led to a wave of public scrutiny and investor backlash.

In the face of mounting pressure, WeWork's board of directors ousted Neumann as CEO and replaced him with Marc Benioff, the CEO of Salesforce.

The company underwent a restructuring, shedding thousands of jobs and scaling back its ambitious expansion plans. While WeWork has survived its near-death experience, it is a shadow of its former self.

The company's fall from grace serves as a cautionary tale for entrepreneurs and investors alike, a reminder that unchecked growth, a disregard for financial discipline, and an inflated sense of self-importance can lead to disaster.

The WeWork saga underscores the importance of building sustainable businesses with strong fundamentals, transparent financials, and a culture of accountability.

Share this post